For a decade, “net zero” was technocratic shorthand for cleaning up the energy system without tanking the economy. In 2024–25, the phrase morphed into a political lightning rod. In the UK, Reform UK framed net-zero policy as a driver of higher bills and red tape; their 2024 “Contract with You” promised to scrap green levies and reset energy policy[1]. In the US, President Trump’s second term has prioritised fossil fuel expansion and has moved to pare back federal support for clean energy, recasting climate policy as an economic burden[2].

In the crossfire, “net zero” became a culture-war label rather than a cost-saving, resilience-building plan. Media and academics have described this shift bluntly: right-populist narratives recast climate policy as an “elite imposition,” which makes the words toxic even when the numbers still stack up[3].

The kernel of truth: UK energy bills do include policy and network add-ons

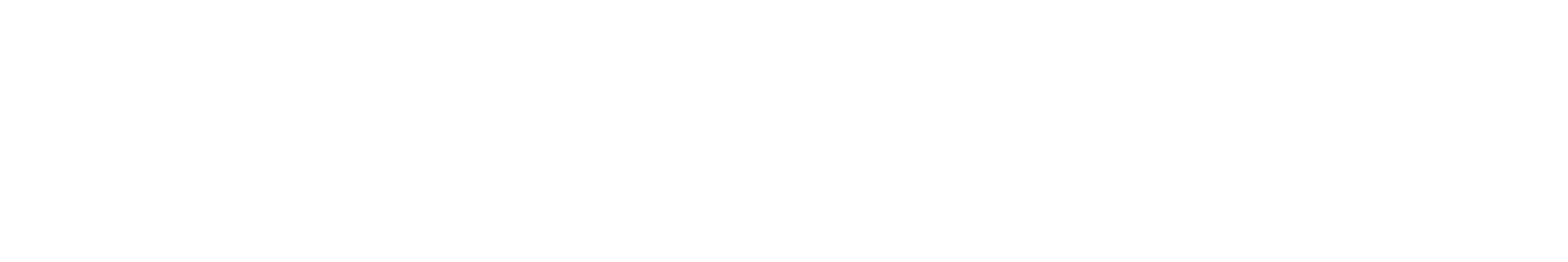

For businesses (and households), the bill isn’t just “wholesale price + supplier margin.” A large share is made of regulated third-party charges. The ones specifically linked to renewable electricity support are:

- Contracts for Difference (CfD) Supplier Obligation — a levy collected from all suppliers to fund top-up payments to low-carbon generators (administered by LCCC). Ofgem includes a CfD allowance in the price cap; Parliament’s briefing explains how suppliers pass these costs through to customers[4].

- Renewables Obligation (RO) — suppliers must present Renewables Obligation Certificates per MWh or pay into a buy-out fund; costs are recovered from customers[5].

- Feed-in Tariffs (FiT) legacy costs — suppliers “levelise” payments made to small generators and recover them via bills; the scheme is closed to new applicants but costs persist[6].

Other sizeable non-commodity charges (not renewables support per se, but often blamed alongside them) include network charges (DUoS/TNUoS), balancing (BSUoS), the Capacity Market, and social schemes. Ofgem’s business guidance lists these components, and recent analyses flag their volatility[7].

These pass-throughs explain why some voters associate “net zero” with higher costs. The OBR also projects environmental levies rising in cash terms this decade (not solely due to renewables subsidies, but it fuels the narrative)[8].

The practical response: generate and store your own power

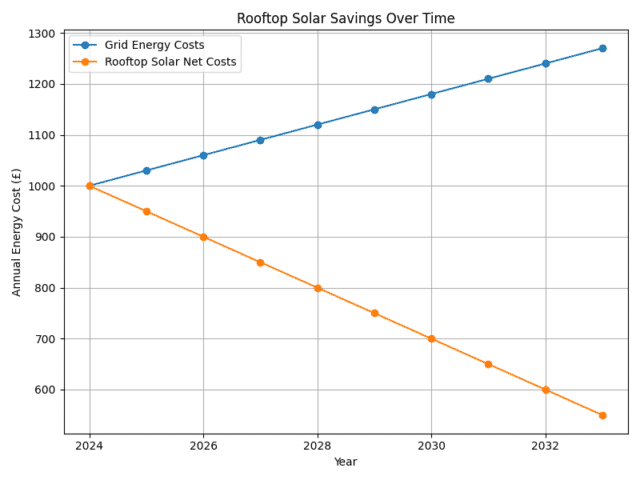

If the problem is exposure to grid energy and its pass-through costs, the solution for many sites is using less grid energy in the first place. Onsite solar (and, increasingly, wind) paired with batteries:

- Cuts grid imports — every kWh you self-consume avoids wholesale costs, supplier margins, and most volumetric levies (RO, FiT legacy, CfD are charged on imported units). Standing charges remain, but the per-kWh stack shrinks. (Mechanics of RO/CfD/FIT cost-recovery: Ofgem & Parliament.)[9]

- Shifts consumption away from peak prices — batteries charge when prices are low and discharge during expensive periods, reducing exposure to peak charges and some time-of-use elements[10].

Hedges price risk — a 20–30-year asset producing onsite power is a natural hedge against market spikes and future volatility in non-commodity costs. Ofgem has been actively reforming network charges, underscoring that volatility is real[11].

Evidence and examples

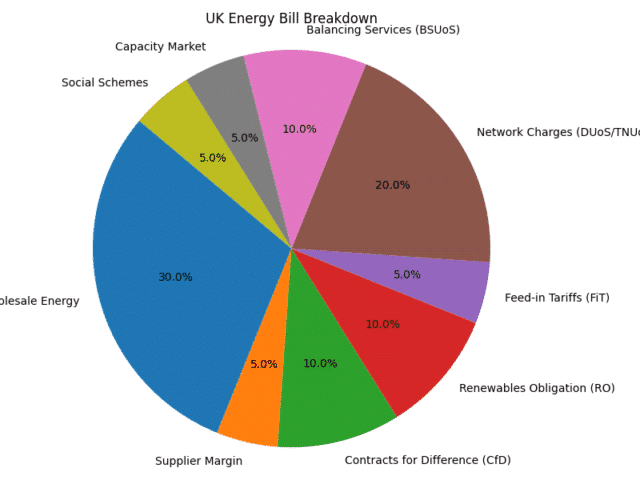

- Savings potential: Sector reports and case material show commercial rooftop solar delivering substantial bill reductions and attractive paybacks (often sub-10 years; shorter on high-load sites)[12].

- Household analogue (directionally similar): independent research found rooftop solar could cut typical household bills by ~24% — demonstrating the first-principles math of self-consumption savings, even though business tariffs differ[13].

Market momentum: Institutional capital is flowing into UK onsite solar portfolios, reflecting confidence in the underlying economics[14].

- Case studies: Industry bodies and installers publish UK business case studies demonstrating reduced imports, peak shaving, and resilience gains from PV + storage[15].

Bottom line: regardless of the politics, onsite generation with storage reduces the number of imported kilowatt-hours subject to levies and network charges. That’s a structural fix to cost exposure, not a rhetorical one.

A simple framework for UK sites

- Load first: Profile half-hourly demand; identify daytime vs evening peaks, seasonality, and flexibility.

- Generate where you use: Maximise PV self-consumption; consider small-to-medium wind where viable.

- Store smartly: Right-size batteries to shift the marginal kWh away from peak tariffs and to capture curtailment/overflow from PV.

- Tariff-aware dispatch: Align battery control with your site’s tariff structure (peak/shoulder rates, Triad/embedded benefits equivalents where relevant, and emerging dynamic tariffs).

- Mind the residuals: You won’t avoid standing charges or all fixed network components (thanks to Targeted Charging Review reforms), so focus analysis on avoidable volumetric costs[16].

How OnGen Expert helps (and where AI fits)

OnGen Expert was designed for exactly this landscape. Here’s how it supports better outcomes:

- AI-driven sizing & siting: We ingest your half-hourly data, roof/land constraints and local resource to simulate thousands of PV-battery configurations. The optimiser balances capex, degradation, tariff shapes, and grant/levy rules to maximise NPV/IRR and minimise LCOE.

- Tariff and levy modelling: The platform models UK pass-throughs (RO/CfD/FiT legacy) and network charges, distinguishing fixed vs volumetric components so savings aren’t overstated.

- Scenario stress-testing: AI scenarios explore wholesale/levy trajectories, battery costs, and policy tweaks (e.g., DUoS/TNUoS reforms), giving you a range of likely outcomes rather than a single point estimate.

- Installer marketplace: When you’re ready to proceed, OnGen Marketplace introduces vetted, reputable installers, shortening procurement and improving execution discipline.

Conclusion

Politicians can argue about “net zero.” Businesses have bills to pay. The fastest, least-regret path through today’s politics and tomorrow’s volatility is to use less grid energy and control when you use it. Onsite renewables with storage do both — cutting costs now and accelerating the transition in a way CFOs, operations teams and sustainability leads can all support.

Ready to cut your energy costs? Use OnGen Expert to model your site’s solar, energy storage, heat pumps, and wind potential today.

Frequently Asked Questions (FAQ)

What is Net Zero?

Net Zero refers to achieving a balance between the greenhouse gases put into the atmosphere and those taken out.

Why are UK energy bills rising?

UK energy bills are rising due to wholesale price increases, network charges, and policy-related levies.

How does onsite solar reduce costs?

Onsite solar reduces costs by decreasing reliance on grid energy and avoiding volumetric levies.

What is the payback period for commercial solar?

Commercial solar installations often have payback periods under 10 years, depending on site load and tariff structure.

References:

[1] https://assets.nationbuilder.com/reformuk/pages/253/attachments/original/1718625371/Reform_UK_Our_Contract_with_You.pdf

[2] https://www.latimes.com/environment/story/2025-01-20/trump-day-one-environment-energy-climate-change?, https://www.climatechangenews.com/2025/01/15/what-trump-second-term-means-for-climate-action-in-the-us-and-beyond, https://www.washingtonpost.com/climate-environment/2025/10/07/white-house-fossil-fuel-concierge/

[7] https://www.ofgem.gov.uk/information-consumers/energy-advice-businesses/get-energy-your-business?, https://www.ofgem.gov.uk/publications/distribution-use-system-charges-significant-code-review-update?, https://www.walkermorris.co.uk/comment-opinion/tnuos-charges-set-to-surge-what-nesos-latest-forecast-means-for-the-energy-sector/

[9] https://www.ofgem.gov.uk/environmental-and-social-schemes/renewables-obligation-ro, https://researchbriefings.files.parliament.uk/documents/CBP-9871/CBP-9871.pdf, https://www.ofgem.gov.uk/environmental-and-social-schemes/feed-tariffs-fit/feed-tariffs-fit-contacts-guidance-and-resources

[12] https://www.renewableenergyhub.co.uk/main/solar-panels/commercial-solar-pv, https://www.harvestgreendevelopments.co.uk/how-solar-panels-save-money/, https://solar4good.co.uk/blogs/commercial-solar-cost-uk-2025/

[13] https://www.theguardian.com/environment/2025/feb/13/solar-panels-could-cut-energy-bills-by-quarter-fuel-poor-uk-families-study